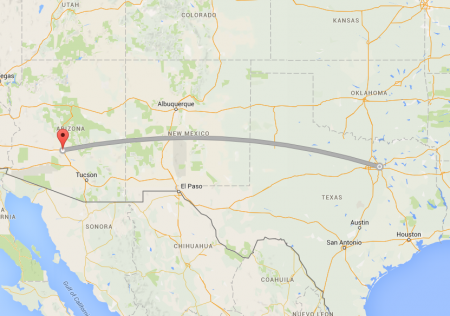

This Teacher is Buying and Rehabbing Properties 1,000 Miles Away

Now a seasoned real estates investor, Jeff recalls the wise words from his grandfather,”Real estate investing is the one area you have more control of than any other investment.”

Although it took years and some exposure to a certain late night infomercial in college, Jeff decided to forge his path as a real estate investor. A teacher by trade, Jeff got started by participating in a weekly real estate investing course, which gave him the confidence to do his first deal.

After gaining experience, Jeff is no longer phased by unfamiliar or distant markets. A resident of Phoenix, Jeff just used his MyHouseDeals membership to buy and rehab a property in Dallas, TX. We sat with him to learn why and how he is buying properites 1,000 miles away.

Because of the long distance, Jeff relies heavily his networking and connections to get a deal done, especially when it comes time to rehab a property. He is the first one to admit that he can’t do it all on his own.

Keeping his grandfather’s words in mind, Jeff has taken more control of his financial future through real estate investments and continues to grow his business.

We sat with Jeff to learn more about this most recent deal and his journey as a real estate investor, including…

– Why you should be looking for properties outside your market

– How to take advantage of creative funding options

– How to properly determine the ARV (after repair value) for a property

MyHouseDeals.com Success Stories

Press play to listen to the full interview and keep scrolling for the full transcript:

NOTE: Since Jeff is a Premium Elite member, he received a FULL refund of his MyHouseDeals membership fee for simply doing a deal! Head over to our success stories section to meet other investors who are doing deals and sharing their stories.

Check out Jeff’s full story here…

Tell us about yourself and your investing background and specifically what inspired you to invest in real estate, and include how long you have been investing.

Actually I live here in the Phoenix area. But right now Dallas is the hottest market in the country. Phoenix isn’t exactly up to par right now. We still haven’t recovered from the crash so we’re working in Dallas right now. I’ve been investing since about 2003 or 2004, started here in the Phoenix area. I’m a teacher by trade so this has always been a part-time thing for me.

We typically do single-family homes. We’ve done one or two duplexes but most have been single-family homes. We started here in the Phoenix area, then we actually moved to Memphis, Tennessee for about five years and worked there from about Christmas time 2005 until about Summer 2010. So we’ve had experience in three different markets now. I absolutely love it. What got me started, you can probably laugh at this, when I was in college, I had a job working in a youth corrections group home. Basically a halfway house for teenage kids. I worked the night shift with a couple other guys. We’d stay up all night, do our homework, and then go to school the next day, which didn’t work out really well. But there wasn’t a whole lot on TV other than infomercials at two o’clock in the morning.

I bet I watched the Carlton Sheets infomercial probably thirty times over that year or two I was working there. That’s what kind of got me kick started. My grandfather was an investor on quite a few houses here in the Phoenix area and I remember sitting down and talking with him after watching that. He told me real estate is the one area that you have more control than any other type of investment. I can attribute inspiration to my grandfather and Carlton Sheets and all the trial and error along the way.

How have you built your real estate investing education throughout the years?

You know, when I started here in Phoenix I was scared to death. We probably went back and forth, back and forth, we’re going to do it, we’re not going to do it. It was a four or five year period before I finally pulled the trigger on the first one. I actually got some formal training, I guess you could call it. I signed up for the Saturday courses with a couple of guys who walked me through step-by-step. I didn’t know what hard money was, I didn’t know how to find contractors, I didn’t know anything. I think with them in my back pocket as sort of a consulting thing, that gave me the confidence to do the first one.

After that it kind of snowballed from there. People always say the first one is by far the hardest and it gets easier after that and that’s true. It got to the point when we were in Memphis, I would buy a house and I knew the neighbors well enough, I knew the guy’s son, I trusted his opinion. So I think it just kind of came with comfort. I definitely paid for the formal training up front and I knew that I needed to have that advice if it came to it. I don’t remember how much I leaned on these trainers or didn’t, but just knowing that they were there to help me in case I needed it. It was probably a couple thousand dollars but I know I took that back with my first investment.

And then a whole bunch of reading along the way. I’ve been to so many different training workshops. I got my real estate license after that.

How much has networking played a part in your success?

Huge! One hundred percent. Here in the Phoenix area when I started, the network was kind of already there. I had a built in network. These guys had already vetted everyone. When we moved to Tennessee, we didn’t know a single soul in the city of Memphis. During that four and half year time in Memphis, I met so many people. Every single one of them is through networking.

When we came back to Phoenix in 2010 we knew we couldn’t really do much business because we were still recovering from the massive crash we had here. But it wasn’t that big of a deal for me to do some homework and pick out a city and decide that’s where I am going to work at. So I identified Dallas as a great place to be right now. I found a wholesaler, went out and met with him. Through him I got ahold of his hard money guy, got ahold of his contractors, and got a whole new title company. I have fantastic lenders, I have three or four wholesalers, and I’ve met with a person I feel comfortable with. It’s a hundred percent networking.

I learned a long time ago I can’t do it all myself and to find competent people, it’s such a huge thing. Referrals from other professionals within the industry, that’s what it’s all about. Now it turns out my hard money guy turned me on to this contractor and I absolutely love these guys. And being a thousand miles away I rely heavily upon them and their honesty. Having that referral from the inside; that’s what it’s all about for me. And being able to work a thousand mile distance from where these homes are at.

What are your favorite features of the myhousedeals.com site and how do you use the site as a resource?

I’m honest here, I’ve never really found a website that is as detailed. It’s almost like being on Ebay shopping. I love it, I really do. Typically in the past I would get the one-off emails from the wholesaler directly. I tried my best to source my own property. I said no, forget it. There’s enough money for everyone to go around. Let them get a cut, I’ll get a cut and we’ll all be happy. Ninety-nine percent of the time I purchase my properties through wholesalers. Your site allows me at any time to see who’s there. I’ll literally stop at work when I’m sitting at my computer, open that email and see what came through that day. It’s very cool, one-stop shopping. I still get emails from other wholesalers who don’t advertise through your website, but I like having the one location to go to for shopping.

What are your plans for this particular deal that you’re getting the refund for?

Ironically we are closing on it today. I’ll sign off and being a long-distance investor, I’ll find a notary to sign them and I’ll overnight them back to the title company. It was basically Grandma’s house! We were able to go in there and put about $65,000 into it. It’s about three thousand square foot and not a single surface was untouched.

We did everything from strip the ceiling to remove the little crusty texture off the wall, which was horrible. Plumbing fixtures all the way through, you name it. We did some foundation work, which is something that I’m still getting used to in the Dallas area. Concrete slab foundation work. I’ve never come across that before. We did a complete cosmetic revival. Very few mechanical issues. We did some upgrading here and there with the A/C system and what not but most of it was super cosmetic. It is in a fabulous area and we found a buyer probably in about three week period, but our closing has been tremendously long because of some outlying title issues that I’ve never come across before.

But anyway, for the most part it was really pretty simple. It was the perfect way to start my investing there in the Dallas area.

How do you find and keep good reliable contractors for your rehabs?

As I mentioned before, it’s all about the networking. There’s a huge difference between investor-friendly contractors, and the guys you call out of the phone book. Not just pricing, but with expectations. I’ve always gone with the contractors who were referred to me through wholesalers or through the lenders. There are a lot of these guys who advertise through your website. A lot of them, even on the emails they send out on your website, they have a list of contractors they’ve already vetted and they’re more than happy to pass you the names of these guys. If they don’t advertise just ask them “Hey, who do you recommend?” Again, the networking and the credibility and the vouching for someone else’s work is important because obviously the wholesaler wants you to be happy because they’re all about repeat business. They don’t want the one-shot home owner. They want you to come back and keep you coming back by providing you with the contacts that they’ve already created. That really goes a long way and helps you as an investor as well as it helps them, to turn repeat business.

How do you go about verifying the after repair value and the cost of repairs?

I assume the ARV (after repair value) is overstated. It isn’t always, it’s tough to put a percentage on it. The wholesalers are not lying. If there are fifteen comps in the area, they’re going to pick out the top four. That makes perfect sense. When you sell the property, the agent or the buyer, they’re going to pick out the lowest comps in that neighborhood to try and justify their offer price. That’s just the way it works. I typically try and find something in the middle. So to keep the numbers simple, if the wholesaler says it’s worth 100 and I can find comps that justify 100 and I can find comps that justify 70, that’s probably what I’m going to offer on. I try and find something in the middle. I always assume the wholesaler ARV is a perfect case scenario.

One of the first things I did in Dallas was find a realtor who helps me list the property when I’m done with it, but she also has full comps when I’m valuing the property as well. You can’t ever undervalue comps from a real estate agent. That’s another network you’ve got to have in place. So if you can find them, they’re looking for repeat business as opposed to the one-shot home buyer as well.

The real estate costs, the house and realtors, that’s really the only true way to determine the ARV. You can’t ever take anybody’s word for it. Take it with a grain of salt knowing where the wholesaler is coming from. And chances are you need to know the exact number, but take it with a grain of salt.

What funding sources do you recommend for new investors in this industry?

I would bet ninety-five percent of the deals that we’ve done over the years we’ve used hard money. And there may have been deals where we could fund the cash ourselves but I’m all about leverage. I understand that I’m giving away some profit, but at the same time instead of more profit at the same time, I can leverage a lot more money. So in addition to hard money when I first started I brought in partners. My parents came in. I had some friends who came in as well. Partners. Don’t be afraid to give away some profit to spread the wealth, so to speak. Once you get your own nest egg, you can kind of go from there and you won’t need the partners, but don’t be afraid to partner with people. That allowed me to get started, where as on a teacher’s salary I could barely save enough money to put diapers on my kids at the time. There’s no way I could have gotten started if I didn’t bring in partners at that time.

Do you now use a portfolio for credibility or do you rely on your network resources when funding properties today?

With the work I started in Dallas, I haven’t really had an issue of people not taking me as credible. I think once you can talk the talk with people and you know the lingo and the language, they know you know what you’re talking about. However, there are some hard money lenders out there who want to know that you’ve done this before. But at the same time if you haven’t done it before don’t be afraid to let them know that. But you need to have done your homework ahead of time to build your credibility that way.

I have had a couple of lenders back in Tennessee that said, “Hey, let’s see what you’ve done.” So I did put together a small portfolio for obvious reasons and was able to explain different exit strategies that we use. But for the most part I think just being yourself and explaining your angle; that’s what all these lenders want to know is how will I get paid back? So I think if you can articulate your end game of how you plan on getting out of this property, the fact that you haven’t done twenty-five properties is even necessarily going to be a big deal to them.

What advice would you give new investors who are just starting out in this industry?

It sounds really simple, but just do it. You’re petrified the first time, I promise you. It definitely becomes easier and more comfortable. That strange Carlton Sheets thing, I remember him saying this from more than twenty years ago now. I remember him saying, “I’m as comfortable buying a house as I am buying this suit.” It will get to that point where as long as the numbers work the other little things are less important. Don’t over analyze. Once you finally have the numbers you know are going to work, when you have everything in place, just pull the trigger, just do it. You’ll have hiccups along the way but it will become much much easier as time goes on.