Real Estate Flipping: Jeff’s First Full Remodel Success Story

In our newest success story, we met with Jeff, a Premium Elite member of MyHouseDeals. He’s a part-time investor who’s been investing for about five years. For the first time in his journey, Jeff went about flipping real estate for market instead of for rental.

One interesting thing that Jeff does is that he outsources his real estate work, so when his virtual assistant (VA) found him a deal on the site that fit his criteria, he jumped on it.

Jeff also understands the importance of collaboration and engaging with contractors. He emphasizes working with someone he trusts to figure out what he doesn’t know. It’s this mindset that will set Jeff up for success.

Topics include:

- Streamlining your business process by outsourcing work

- The importance of private money as a funding source for deals

- How holding a rental differs from turning a flip

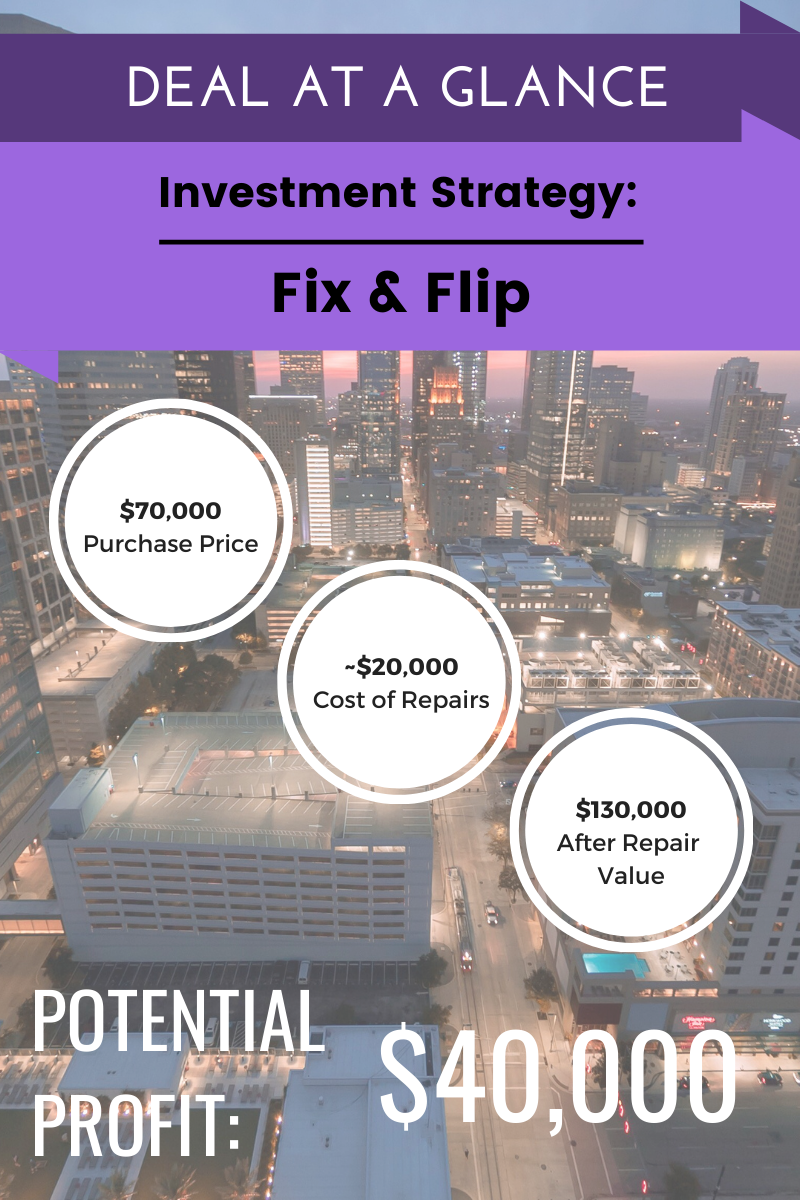

Here’s a quick breakdown of Jeff’s deal:

You can listen to the audio here:

Or you can watch the video here:

So, to kick us off, can you tell us a little bit about you and your investing journey so far?

I started about five or six years ago, renting out my first house when we moved into the house that I live in now. That was my first landlord experience. I found a house, and another one, after that. So then I refinanced that rental, pulled some cash out, and bought another rental. I was then a landlord of two deals.

I tried my hand at wholesaling and failed, and realized . . . I’m not good at wholesaling. And so, I did that for about a year and then tried lending. I was a hard money lender for about two years, which was good, and I got to see how the other side of a transaction. It was good because I’m a W2 employee. It was cashflow with my rentals and I did not have to be involved, but I also got to see how these rehabbers can make a good bit of money and they’re finding good deals. It’s been a pretty positive experience.

For this most recent deal, it’s going to be a full rehab. That’s what I wanted. I want to get into something more than just cosmetic, that I’ve never done. It was really kind of getting out of my comfort zone, but it was small enough that any mistakes, in such a small property, I could be able to maneuver. It’s still small enough, I can refinance and rent it if I need to. So I’ve got multiple exit strategies.

Was it always your goal to become a real estate investor?

I really liked the real estate. However, and I will tell you, I really . . . for all my time and investing, I wanted to grow this massive rental portfolio. That’s what I really wanted; that passive cash flow, that retirement type of deal. However, now we’re in the COVID period and I got a taste of that rehab and then I just got another taste of it.

So you’ve mostly done rentals, but now you have a rehab. Not everyone can do what they were comfortable with before. You’ve got to go with what the market’s doing, right?

Correct, and I will tell you, I like being a landlord. I like providing a good service, a good product, and having that monthly check. I’ve heard many nightmare stories. I’ve had a couple of bad situations and I tell anybody, you need to get into this because nothing has scared me away from it. But, to a point, adapt, right? Now’s the time to cash up. I assure you, I will get more rentals like this property in Conroe might turn into one. It just depends on how the rehab comes out and how many buyers I get. I’m already getting lots of bites and it’s not even done yet.

So how long have you been a member of MyHouseDeals, what were you looking for, and how many properties did you have to look through before you found this deal?

I guess a few months. I have a virtual assistant (VA) who goes and combs it, and I wanted him to have as much access as possible. And I was absolutely looking for my next flip. I have two different criteria and it will be based on cash flow or based on profit potential.

My VA and I went through a lot of properties before we found this deal. He combs the website and puts it all into a spreadsheet for me. Everyone’s process and criteria are different though. And then the next part is, “Well how many did I go and see?” And that number is a lot, too. Deals don’t just fall into your lap sometimes.

So, when you saw this particular deal, what made you think, “Okay, I’m going to go after this one. There’s potential here?”

Well first of all, like I said, it was a full rehab. This property needed everything but the roof done. We’re talking foundation, siding, you name it. Which would normally cause a lot of investors to run away from it.

But everybody is running away. I’ve done like four deals already where it’s like paint, put some recess lighting, and do it so everybody’s looking for that. But I can be the guy that these wholesalers say, “This place is a dumpster fire. I know that Jeff will take it,” and they call me first. Then I’ll be first on the list. And, that’s what I’m going after.

And because of that, I can avoid a lot of the competition.

So tell us a little bit about the property. What are the details and what is your vision?

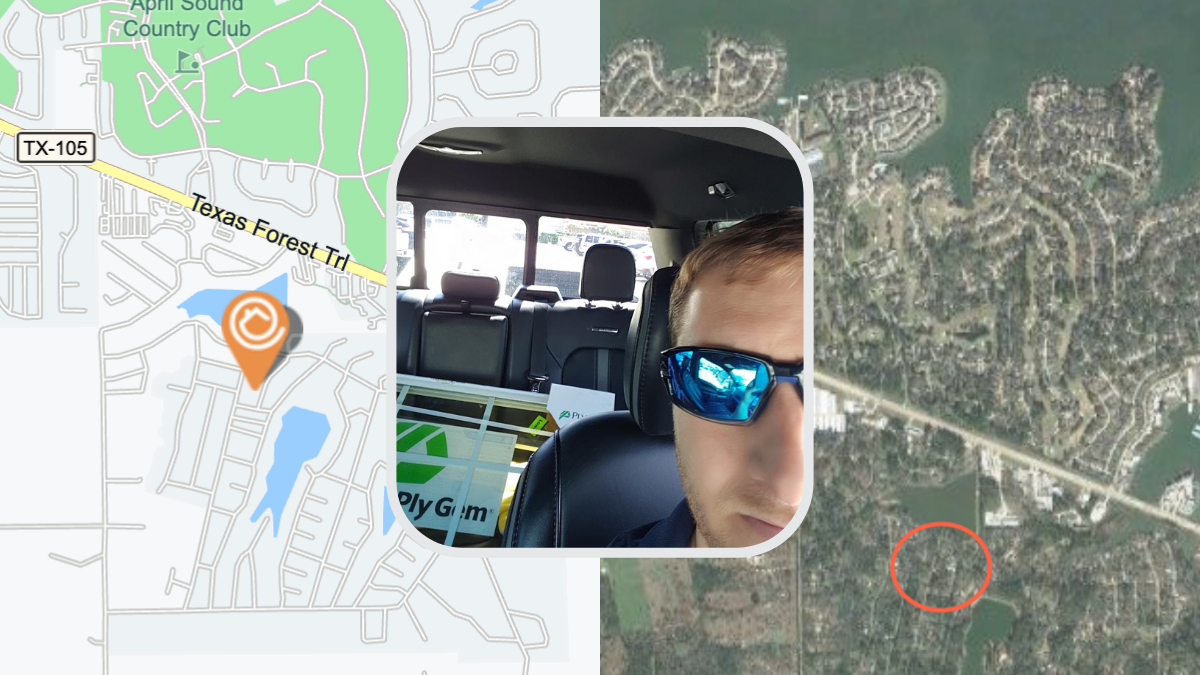

It’s got two bedrooms, one bath, 996 square feet, but it’s on a quarter acre. The zip code is Magnolia, but technically it’s like Conroe right off of 105, across from Lake Conroe and it’s like two houses away from the Lake. The neighborhood itself, when you go into this little community, it’s almost like this little fishing, boating village. So, it’s got this really cool feel.

I took my wife with me to see it and she took two steps into it and said, “The land in the area is going to sell it.” So I had a green light from her!

As for my vision, I want to make it a really cute little villa or a bungalow. With the new siding, I’m going to paint it a cool light green with the white trim. I’m going to put in a gravel driveway. It’s got a little porch and the recess lighting, granite that the whole nine, it’s going to be HGTV-style.

With all the activity going on, a neighbor of the property has already said “I’m interested in maybe buying this for my daughter.” Which is the best kind of deal you can get.

Walk us through some of the numbers. What were they asking for?

They wanted $80,000. I got it for $70,000. So that is different about this market, because most everything’s going to be a bidding war. But this was a bit of a situation of a house and they weren’t getting a whole lot of buyers.

Based on my inspection, I went in and said, “Look man, this is going to be this much.” And I actually had a foundation guy go and told him, “Hey, dude, I’ve never done a foundation. How much is this going to be?” So, I use that as leverage to say, “You’re saying the after-repair value (ARV) is this much. You can’t even pull comps because it doesn’t justify. Let’s meet in the middle here because the thing is a rollercoaster when you walk inside.” So really, the same thing the wholesalers do to the sellers. Man, this is going to be really tough.

I wanted it for $60,000 but since I was working with a wholesaler, I needed to make it a win-win-win for everyone. It only took about two days to close, too.

And so, did you use private money to fund this?

I did. Private money is so important to utilize. I work primarily with just one lender. Usually it’s like, hey, here’s the deal. Here’s what I see on the ARV, here’s the costs with my estimate. And here he needs the contract and the title commitment and then we go from there. Once it all checks out for him and he’s protected with title and the insurance, he’s a businessman, he gets his points and he gets his interest, right? Ten and a half percent.

I keep them updated on the progress of the project. He holds back repair escrow, which is fair, and he gets his money. And I think he knows it is safe with me. I’m a safe bet if you would, and he’ll get his interest payments and my goal is to complete the project and get his principal back to him.

Since you’re flipping this property, how much are you putting into it?

I’m a little bit over. In fact, I talked with my lender yesterday, I said, “I’m trending to be about five grand over,” and he laughed. He said, “I told you that when you sent me the budget.” He said he’d never done a full re-model. There’s always an “uh oh.”

The building materials are killing me and we ripped off the siding and there was a bunch of wood rot on the bottom. We had to replace a bunch of two by fours. So that part’s on me and that’s fine. I adjusted for that and I’m okay with it. So, I budgeted fourteen grand. I think I’ll come out at 20. That’s what I’m trending. Part of the increase was that I decided to change all the windows. But it’ll be worth it.

So you got it for $70,000. Let’s say you’ve put in $20,000. All in you’re at $90,000. What are you hoping to get for it?

I had three verbal offers at $125,000. I think I’m going to get aggressive if I don’t get a contract before I finish, because if people had seen it in, it’s a destructive state right now, the stuff’s all in the front, there’s no floors, it’s a mess. They wanted it at $125. I think I’m going to get aggressive and list it for $140,000, thinking I can get $130,000. So all in, I’m hoping for anywhere –$50,000 in profit.

When are you hoping to get the property done and listed?

I just had the conversation with the guy he asked and I said, “I really think I’ll be done the week of May 3rd.” That’s how I see it. Weather delays aren’t awesome, obviously. That’s just how it’s looking. They started the interior paint yesterday. I’ll drive over there tomorrow. I got a couple more pieces of material to bring them, but everything has been purchased. I really think by that week of May 3rd, it should be done.

And I don’t want any holding costs. We’re in such a competitive market that incurring holding costs is going to hurt. But as I said, I’ve had three verbal offers already, so hopefully it’ll sell soon.

From your experience working with contractors on a larger scale project like this, what have you learned, compared to working on these more paint and carpet and done types of deals?

Yeah. I think it’s more learning about the job itself. Uncovering things and I’m learning what that is. I’ve never owned a pier and beam house, so to see the floors ripped up and you see into the ground, that’s something else.

So I had the foundation guys, and then I had my lead contractor, who I trust. So after they were done, I had him come out like, “Alright, you ready to start everything?” He was kind of my eyes and ears, saying they need to come back out because of this and the other factor.

So, because I don’t know what to look for, right? You got to have somebody that you trust on some kind of big job like that, where I can look for those things. I think it’s more finding out what I don’t know. And then, I didn’t purchase a lot of wood for those other jobs. Wood is really expensive right now!

That’s a great approach to flipping. You don’t know what you don’t know, so working with the experts is key.

I will say this. I am blessed in the fact that I am not a ‘know it all’ or a ‘do it all,’ especially not to do it all. I’m a big believer in outsourcing. I just picked up what I am hoping is another crew and I’m looking forward to getting another deal where I can try them out.

And so, then I can do another project. And so, I’ve got the funding lined up and then hopefully another good crew that I think I like, and I think they’re trustworthy. So I want to put them to the test because I can tell this guy he’s stretched thin and he does good work.

So what’s next for you?

Right now I’m liquidating. I’m trying to get cash-heavy and then I will acquire more rentals, as I see fit and I really want to get into that small multi-family area. I’ve looked into the multi-family. I’ve been to the syndication seminars, which are very hoo-rah. I don’t think I want to syndicate.

I don’t think that’s anything that I’m interested in, but I think I have X amount of financing from a bank. And if I have the right amount of liquidity, I can come up with the remaining balance and then have the resources, meaning, the crew, a management company to manage those, six to 50 unit complexes that the big syndicators don’t want. So that’s the direction I’m going. And then I also think that even further down—I think those are deals that typically will get seller-financed and I’d be happy to sell those with a budding investor.

I’m also in acquisitions mode right now. I would tell anybody who’s listening that once you get a base hit and really, two, it’s that momentum will just go.

So what advice do you have for other investors, new or otherwise?

My advice is, I’m looking back now . . . I wish I could remember all the ones that I thought, “No, I’m not going to buy this right now.” Because my goal five and six years ago was to buy two rentals a year. And if I had done that, I’d have ten properties to liquidate right now.

And so, just have something in mind. I don’t know why I stopped, right? I bought two that year and that’s what I’m liquidating. Now I have three other ones for berries, because I bought two last year. So don’t slow down. I’m telling you from personal experience, the five-year plan works.

And you have got to take action! Don’t be afraid of some hiccups because I have made some booboos. I made some booboos, but it’s hard to really mess up in this business. It’s very forgiving.

Summary

Jeff got his start in real estate investing with rentals, and his first deal on MyHouseDeals ended up being one of the biggest projects he’s taken on. Instead of flipping for a rental, Jeff decided to take on a full property flip.

With how dramatically the market has changed within the last year due to COVID-19, Jeff had to go with what the market was telling him to do. A full flip was out of his comfort zone, but in this seller’s market, it was the best course of action for him.

Working with a team, Jeff has streamlined his business by having a VA comb through listings to find the deals that will work for him, as well as working extremely collaboratively with contractors.

Thank you to Jeff for sharing his story with us! We wish you continued success!